Regulatory flux and the path towards continuous compliance

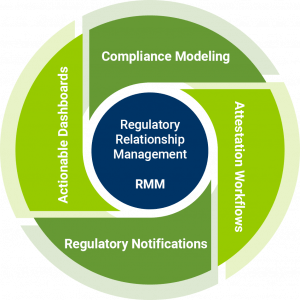

Last month we touched upon Regulatory Relationship Management (RRM) as a framework used to satisfy regulators and their regulatory requirements. Here, we point to the next steps forward by addressing the challenges and impacts of non-compliance and providing you with thoughts on assessing your current compliance state—finishing off with actionable remedies to avert non-compliance.

“The cost of non-compliance is 2.71 times higher than the cost of compliance”

— Ponemon Institute and Globalscape“The True Cost of Compliance with Data Protection Regulations”

The Top Challenge to Continued Compliance

For highly regulated financial institutions, having an effective regulatory compliance strategy is a fundamental part of the business process. Organizations that are compliant with regulations have an advantage in terms of winning customer trust. A vigilant organization will reduce the potential negative impact on its brand. On the other hand, companies struggling with compliance are exposed to the risk of fines, business disruption, and reputational risk. The effort to repair a company’s reputation and restore customer confidence can be daunting.

A compliant organization optimizes value for its customers and minimizes risks. Nevertheless, keeping up with the sheer amount of constantly evolving regulations has become increasingly challenging. A global survey by Thomson Reuters Regulatory Intelligence backs this up by revealing that the top challenge to continued compliance is regulatory flux. Regulations are constantly being amended and revised to reflect social, cultural, political, and technological changes in the regulatory environment. Compliance requirements across international jurisdictions only add more complexity to the regulatory burden — a burden that does not look to loosen.

The Price for Non-Compliance

Organizations must remain vigilant for gaps in their regulatory programs. While the price tag for compliance measures may seem costly, the potential costs for non-compliance include operational disruption, decreased investor confidence, legal fines and penalties, diminished brand value, and loss of employee morale. Ultimately, according to a study by the Ponemon Institute and Globalscape, the cost of non-compliance is 2.71 times higher than the cost of compliance.

Assessing Your Path

Key indicators

The ability to course-correct depends on people-readiness and process adoption. Asking the following questions will inform your next steps towards regulatory risk mitigation:

The ability to course-correct depends on people-readiness and process adoption. Asking the following questions will inform your next steps towards regulatory risk mitigation:

- Are adequate risk assessments in place?

- How thoroughly are you assessing your compliance risk exposure?

- Do you have enough skilled staff allocated for compliance?

- How sufficient is your technology in managing compliance?

- What is your company’s attitude towards compliance?

- Who is accountable for non-compliance?

Actionable Remedies to Non-Compliance

Build a Culture of Compliance

Actionable Remedies to Non-ComplianceCompanies strengthen their compliance culture by plugging the gaps in their policies and procedures and putting into place reviewing and monitoring mechanisms. They conduct compliance training and communications with a strategic intent of curbing non-compliance. Making personnel policies, screening, and evaluation of employees, vendors, and agents mandatory for vigilance and course corrections is also part of the remedy. Instituting monitoring, auditing, and internal reporting systems, including disciplinary measures for non-compliance is another. Most importantly, setting the right tone at the top is vital to maintaining a healthy compliance culture. To do so, companies create the role of the chief compliance officer, who is empowered with responsibilities of monitoring regulations, managing compliance, and mitigating business risks.

Make way for intelligent automation

Regulatory technologies provide the capabilities for companies to be up-to-date with the magnitude of regulations as they change. Workflow tools enable the relevant stakeholders to access the impacted regulations so they can take corrective measures. Archiving, retention, and disposition technologies allow companies to preserve information as per compliance requirements and make this information searchable and accessible for future inspections. Encryption prevents leakage of confidential data and alleviates privacy concerns. Cloud storage technologies enable companies to save on hardware and infrastructure costs. End-to-end business process automation significantly improves productivity.

Unify the information governance activities

Tie these individual regulatory technologies together, and you can create an automated, unified governance infrastructure. This unified infrastructure will enable you to achieve policy integration and process transparency across your records management life cycle. You can generate risk reports instantly and monitor the compliance health of your organization through comprehensive dashboards.

One such product that can create your unified governance infrastructure is Infobelt Omni Archive Manager. Infobelt Omni Archive Manager is an advanced data archiving platform for all data types that enhances information protection and privacy and increases process efficiency. It gives businesses a comprehensive process to allocate, organize, and archive data according to industry regulations.

Putting It All Together

Once your organization understands the value of compliance and is ready to take action, you may want to find and consult with a regulatory technology partner, such as Meji Partners or Infobelt, and utilize their services. Infobelt is the only company that delivers a complete end-to-end books and records management system. Meiji Partners provides an independent advisory voice that helps uncover hidden risks and challenges presented by regulatory obligations.

Once your organization understands the value of compliance and is ready to take action, you may want to find and consulaBy proactively reducing the likelihood of a significant non-compliance event, an automated information governance strategy sets your organization apart in the marketplace. It gives you a competitive advantage while also protecting your brand.t with a regulatory technology partner, such as Meji Partners or Infobelt, and utilize their services. Infobelt is the only company that delivers a complete end-to-end books and records management system. Meiji Partners provides an independent advisory voice that helps uncover hidden risks and challenges presented by regulatory obligations.

Share posts