_ _ Infobelt

CRM for Regulatory Compliance

Meeting compliance goals through Regulatory Relationship Management (RRM) Framework

RRM stands for Regulatory Relationship Management. To understand RRM, let’s start with something more familiar to you, such as Customer Relationship Management (CRM). Probably when you think CRM, Salesforce comes to mind.

CRMs such as Salesforce align your business model to your customer relationships. The goal of CRM is to drive your sales to funnel and retain customers. Similarly, RRM aligns your business and compliance model with your regulatory relationships. The purpose of RRM is to satisfy regulators (precisely their regulatory requirements).

In CRM, you are trying to understand the customer and satisfy their needs. In RRM, you are trying to understand the regulator and meet their needs.

What is RRM?

RRM stands for Regulatory Relationship Management. To understand RRM, let’s start with something more familiar to you, such as Customer Relationship Management (CRM). Probably when you think CRM, Salesforce comes to mind.

CRMs such as Salesforce align your business model to your customer relationships. The goal of CRM is to drive your sales to funnel and retain customers. Similarly, RRM aligns your business and compliance model with your regulatory relationships. The purpose of RRM is to satisfy regulators (precisely their regulatory requirements).

In CRM, you are trying to understand the customer and satisfy their needs. In RRM, you are trying to understand the regulator and meet their needs.

“Taking a proactive approach to regulatory compliance saves reputation, money and hundreds of man-years”

— RegTech industry expert

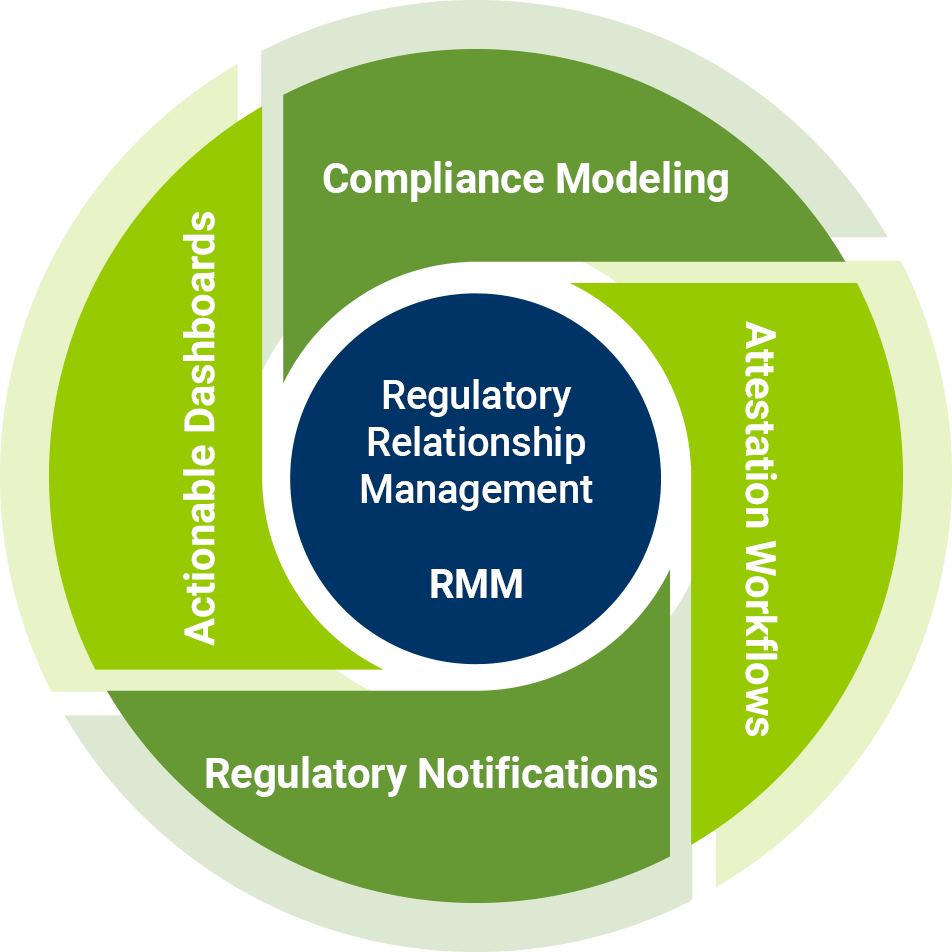

What are some of the key features to look for in an RRM solution?

Modeling your operational and compliance framework

Most importantly, your RRM should let you create a model that addresses your organization’s operational and compliance demands. Your RRM should link regulations to required regulatory records, then map your books and records to your compliant archives. These are just a few examples, but the RRM solution should be flexible enough for you to create an accurate representation of your real-world operational and compliance characteristics.

Customizable workflows with built-in attestation models

Equally as important, your RRM solution should have customizable workflows that ensure that each line of business within your organization completes specific regulatory tasks to remain compliant. The world’s top RegTech companies suggest that you customize these workflows to each line of business and be scalable as your organization grows. Keeping these workflows as simple as possible is a significant factor in ensuring adoption throughout your company.

Actionable dashboards with real-time compliance health-scores

A good RRM solution should have actionable dashboards that give business leaders a compliance health score in real-time. Workflows with built-in attestation models will feed the dashboard, highlighting any areas within the organization that require remediation. “Taking a proactive approach to regulatory compliance saves reputation, money and hundreds of man years,” suggests a RegTech industry expert. “This approach will allow business leaders in the Financial Services Industry to get ahead of issues long before they have become a serious problem.”

Notifications regarding regulatory changes and business impact

What would a Regulatory Relationship Management system be without regulations? A significant component of any RRM is that it is updated with the newest rules and regulations constantly. The design of your RRM must notify relevant stakeholders about which regulatory requirements have changed, provide the impact that the regulatory change has on the organization, and have the necessary workflows to manage the regulatory change properly. “Without a constantly updated and direct feed, an RRM is rendered useless,” suggests a RegTech Operations Leader

Notifications regarding regulatory changes and business impact

Analysts suggest that the regulatory compliance technology industry will see a growth rate of over 52% through 2025. RegTech companies provide financial services firms, such as investment banks, commercial banks, private equity groups, and insurance companies a proactive and strategic approach to keeping up with the constantly changing regulatory landscape.Analysts suggest that the regulatory compliance technology industry will see a growth rate of over 52% through 2025. RegTech companies provide financial services firms, such as investment banks, commercial banks, private equity groups, and insurance companies a proactive and strategic approach to keeping up with the constantly changing regulatory landscape.

Learn more about RRM RegTech solutions. Email us at info@infobelt.com.